By Jeremiah McBurrows, Heritage High School, Frisco, Texas

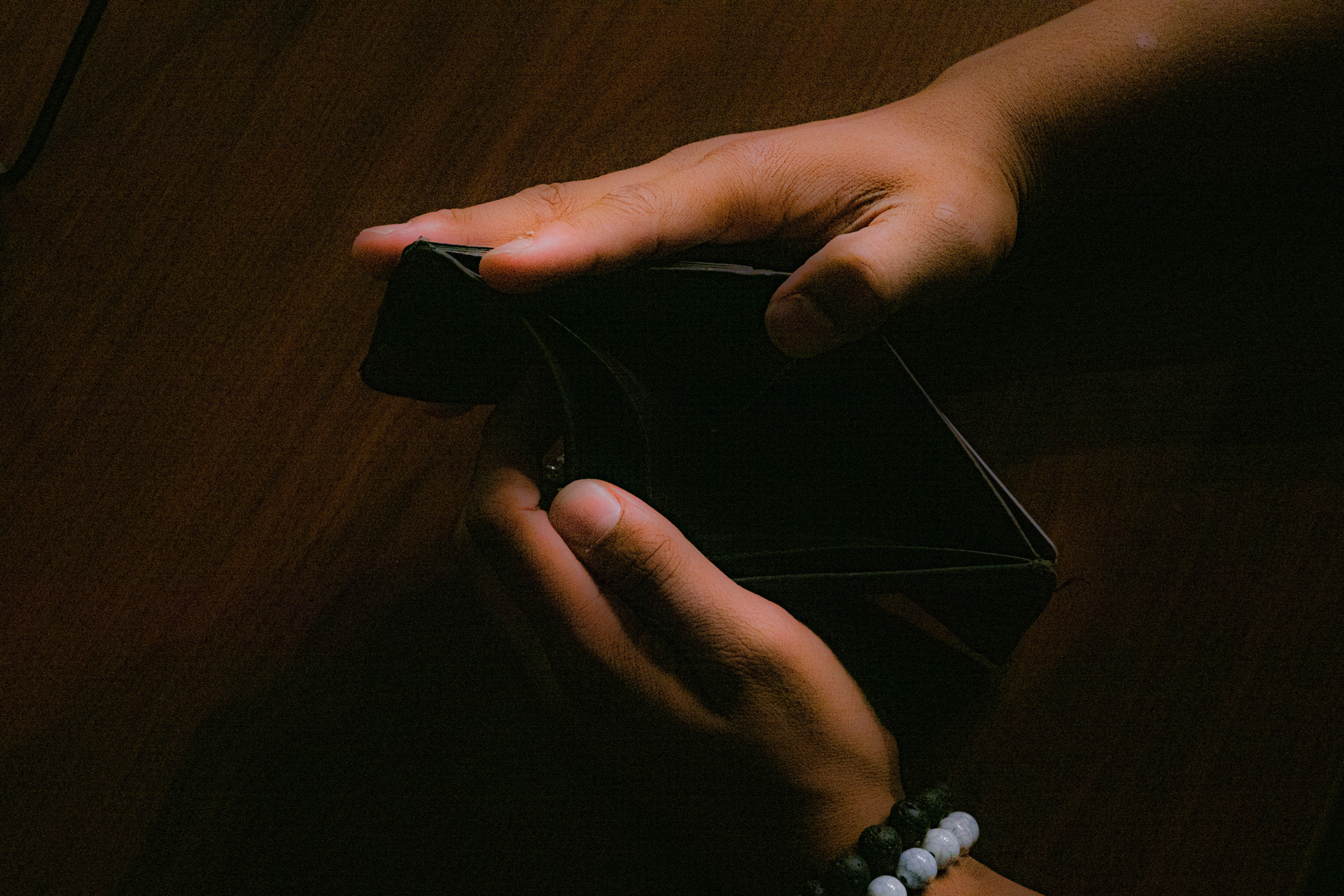

In light of the recent Supreme Court decision to strike down President Biden’s student loan forgiveness program, college students and graduates across the nation were stripped of a chance to be relieved of a major financial roadblock in their lives.

Gigi Robertson, a recent graduate from the University of Oklahoma, describes her thoughts on the matter.

“There was an opportunity for me to pay off my debt. I think anyone would be upset if they had the chance to do it and it was taken away,” Robertson said.

According to US News, the average college student obtains $30,000 in debt by the time they graduate. This puts many graduates at a disadvantage after they leave school, affecting their economic mobility for years to come. Along with President Joe Biden’s Student Loan Forgiveness program being struck down by the Supreme Court on Jun. 30, 2022, many college students and graduates looking forward to that financial burden being lifted by the relief programs were let down.

“I was very upset because I think, like max, they would have relieved everyone was $20,000 and that would have been half my debt,” Robertson said.

What can students/graduates do?

Paying back student loans requires plans, and universities such as OU offer programs like Money Coaches which allow students to have a “financial professional available to all students at the University of Oklahoma,” according to the OU website. These coaches are assigned to each incoming freshman, starting off their college career with opportunities to succeed financially in college. These coaches aim to help students build lifelong money management skills and navigate the process of paying for college. Along with this, they also offer financial literacy workshops across campus to better educate students on how to manage their finances.

With the help of Money Coaches, OU students such as rising OU senior Faythe Miller find comfort in the help they provide, while not completely alleviating the financial commitment that getting an education requires.

“They definitely help alleviate stress…they can help mitigate those like stressors and difficulties paying for college,” Miller said. “As a student, it’s hard to take out loans…but they provide comfort with that and I think they’re a good point of reference for how to…maximize your opportunities and everything. But I think, if I’m being honest, as a college student, I would be silly if I didn’t say I worry about how much I’ve had to spend on my education.”

Scholarships are also a way for students to avoid the hardships of paying off debt, and rising OU senior Evan Whitaker knows this. His involvement in his community and his desire to seek out scholarships led him to find financial aid.

“I applied for the Sinclair Diversity Scholarship, which was a third-party merit scholarship,” Whitaker said. “The other scholarships that I got were reoccurring scholarships in Gaylord, specifically for journalism. One was called the Stan Lee Evans Rewards scholarship…the other one was another diversity scholarship that I got for being officially the president of the NABJ, which is the National Association of Black Journalists.”

Generosity from those wishing to spread their wealth is also useful for students seeking scholarships.

“(The Stan Lee Evans Rewards scholarship) was from a dean whose daughter passed away and he’s using his money to kind of give back to the community,” Whitaker said.

OU graduate Mariah Wheeler describes part of the process of finding financial aid for university. “You have a big pool…You have to go and do that work yourself and find different links, even outside places, maybe like a law firm…different people and sponsors and donors will have scholarships,” Wheeler said. “I would save all the ones that I’m eligible to apply for and wait and see if somebody came.”

Another common method of paying back loans is receiving assistance from family members. Students such as recent graduate Aamir Sandhu make good use of their family’s financial stability to lower stress. His father is a doctor, and Sandhu says his father wants him to spend this time finding out what he wants to do with his journey, this helped him find an interest in psychology.

Whitaker also receives help from his family.

“Mainly, my parents have been kind enough to offer to help pay it off,” Whitaker said. “In addition to me working and supplementing also.”

Opportunities, like those previously discussed, may be out there for students to find, but sometimes they aren’t as out in the open as they could be for newcomers to college life. In the eyes of someone like Whitaker, who is experienced in hunting for scholarships, they aren’t advertised how they should be to incoming students,” he said.

“I think as far as freshmen, they need to do a better job with instilling knowledge on all of the resources that freshmen have at their disposal. There’s so many freshmen that have absolutely no idea how to get started with scholarships, where to start, when to apply, how to apply, and I feel like they should really just do a better job about maybe even giving a prerequisite or a class or something…to help students understand all of their available opportunities.”

Scholarships are also available for outstanding academic performance, which Sandhu and Wheeler have taken advantage of.

“I just have one scholarship,” Sandhu said. “If I remember it was for the ACT.”

“I had a National Award Scholarship…like merit-based ones on like ACT scores,” Wheeler said. “I got a couple of thousands for that. And then I was part of the President’s Leadership Class.”

Opinions on Supreme Court

In the Supreme Court case of Biden vs Nebraska, which determined whether the Student Loan Forgiveness program would go into action, Biden claimed in August 2022 that the HEROES Act gave him the power to enact his program. The HEROES Act was passed in the wake of Sept. 11, 2001, giving the government the power to change student loan programs in times of war or extreme distress. In 2003, the law was extended to give the government the ability to provide student loan relief under the same conditions. Biden’s unveiling of the debt relief program was done while he believed that the COVID-19 pandemic offered a reasonable enough environment for the program to be run under the HEROES Act, according to The Texas Tribune

Chief Justice John Roberts felt otherwise, as he wrote in the majority opinion against the program.

“The HEROES Act allows the Secretary to ‘waive or modify’ existing statutory or regulatory provisions applicable to financial assistance programs under the Education Act, but does not allow the Secretary to rewrite that statute to the extent of canceling $430 billion of student loan principal,” Roberts wrote in the 6-3 majority opinion, according to The Texas Tribune

The ruling means all students with debt will need to resume repaying their loans in October.

The Supreme Court’s decision has left many across the country upset. The program would have offered a way for people to be relieved of a large portion, or in some cases most, of their debt from student loans. Here are a few opinions on the Supreme Court decision from some students and graduates from OU.

“I’m furious. I have racked up so much student debt going to school out of state and I understand that people are like, well, it’s your decision to go to school out of state. I totally get it but there was an opportunity for me to pay off my debt,” Robertson said. “I think anyone would be upset if they had the chance to do it and it was taken away.”

Whitaker expressed his thoughts on the matter.

“My opinion is one of slight disapproval. I do feel as if debt relief and student loan relief is a big pressing issue in American society as of right now,” Whitaker said. “I’m definitely disappointed in our current government systems and I look forward to changes in the future.”

Miller also gave her thoughts.

“I think that money shouldn’t be a barrier to education,” Miller said. “I think that access to education and information should be available for everyone. I think that’s like how we as a society grow and support each other as people. So anything that could potentially help contribute to further education or further the relief of the burden of higher education on people…is really monumental and something we should support. So it’s disappointing to see something like that happen…something like that is a step to help mitigate those issues and everything so it was disappointing to me.”

Wheeler also had something to say.

“I mean, as a student, we all have student debt…I know like adults and things that like their student debt is a lot of what’s keeping them back in life especially like with their credit and when they’re buying a house and things like that.,” Wheeler said. “A lot of people, if that debt, if that relief was able to be implemented, instead of being struck down, would change a lot of the way that they move about their life. Because student debt is a burden on a lot of the country…I don’t know the logistics of like, why it’s being handled the way that it is…I guess what we all hoped for and like, had like, “Oh, this maybe can happen.” That hope for a lot of people to know that that’s kind of the pressure a little bit is a little sad.”

What Comes Next?

Those hoping for financial relief from President Biden may still receive it, even with the Supreme Court taking down Biden’s first attempt.

Directly after the Supreme Court ruling, Biden held a news conference and gave his statement saying, “The fight is not over.”

“I think the court misinterpreted the constitution,” Biden said, as he expressed his desire to move toward a different law and push the Student Loan Relief program that way.

As the president searches for a way to provide the financial relief that many Americans desire, college students and graduates currently must wait for action to be taken.

Wheeler gave a thought.

“ I wish it were different, but we’ll see how it goes,” Wheeler said. “Just keep moving forward and hopefully more legislation and when people come out and try and find a better compromise and something that will give at least a little bit of relief for people who need it.”

Hope for a better financial future is a constant amongst Americans, but in the end, patience is key.

Patience and hope are necessary for those who wish to see a change in the current American debt system. Expectations are high for change, and now the change is the American government’s to make.